This could mean everything.

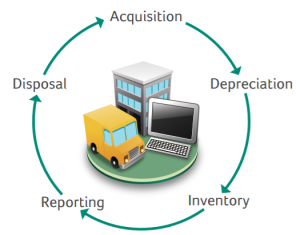

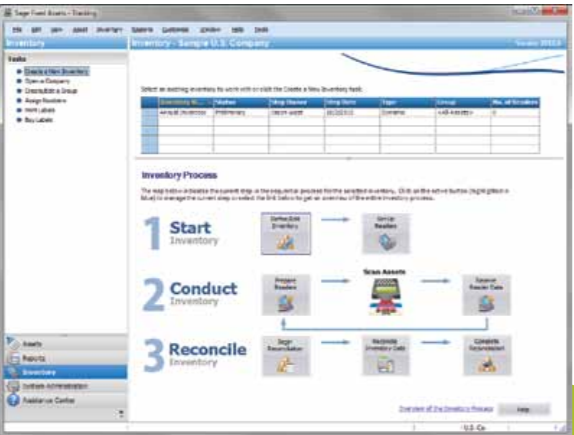

Acronyms for regulatory agencies, laws, and even forms run the gamut: IRS, IFRS, GAAP, SOX, GASB, CCA, T2S8—but your compliance can’t. Even the most minute changes in financial and tax rules, including exemptions, can mean the difference between major penalties and major cost savings. And the detailed administrative tasks required to manage fixed assets effectively can overwhelm an organization of any size. Whether you’re a business entity, government office, or nonprofit organization, you need Sage Fixed Assets—Depreciation. Thanks to an intuitive user interface, Sage Fixed Assets—Depreciation gives you the flexibility to manage the entire fixed asset lifecycle—from acquisition to transfers and disposals—for both public and private organizations. And with advanced fixed asset accounting and reporting features, Sage Fixed Assets—Depreciation can help you prepare your year-end financials, allocate costs, calculate depreciation, eliminate redundant data entry, and store digital images of key asset records such as purchase orders, warranty information, and insurance records. A comprehensive solution, Sage Fixed Assets—Depreciation offers more than 50 depreciation methods including MACRS 150 percent and 200 percent (formulas and tables), ACRS, Straight-Line, Modified Straight-Line (formulas and tables), Declining Balance, Sum-of-the-Years-Digits, as well as user-defined. It helps ensure compliance with government regulations, integrates with popular general ledger systems, and comes with more than 30 ready-to-use reports, including year-end financial statements, fileable U.S. IRS tax forms and worksheets, as well as Schedule 8 Capital Cost Allowances for Canadian T2 Corporation Income Tax Returns. Sage Fixed Assets—Depreciation also includes the ability to allocate cost and depreciation for an individual asset or groups of assets to more than one funding source, decision making tools to ensure GASB 34/35 compliance, and the ability to create budgetary books for asset budgeting projections. Want more information about Sage Fixed Assets—Depreciation? We’re here to help! Give us a call toll free at 800-368-2405 or visit: www.SageFixedAssets.com